🧠 Investment Psychology: The Market Isn’t Just Numbers — It’s Human Behavior

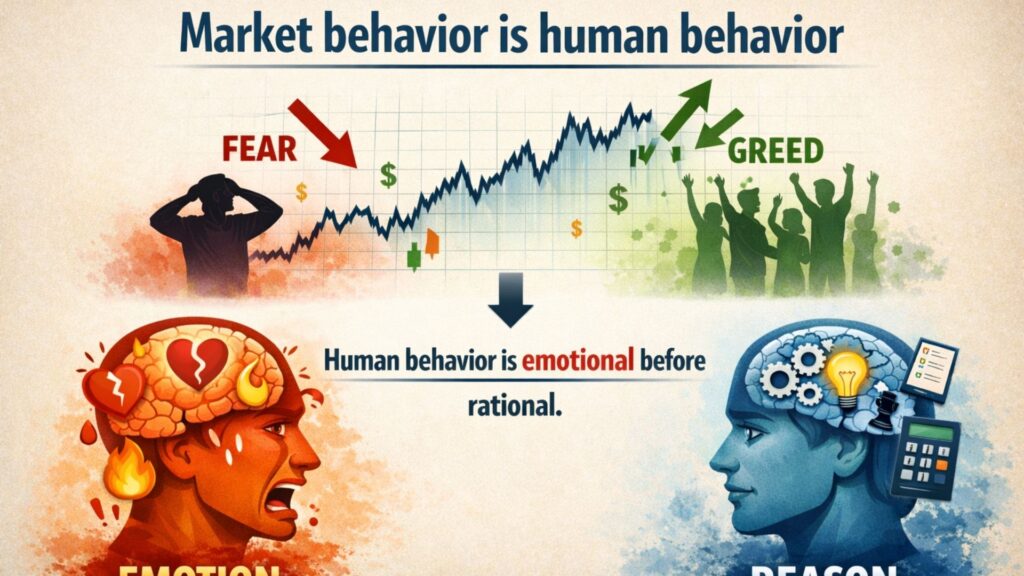

Many people believe the stock market purely reflects economic data or company performance. That’s partially true — but it’s not the whole picture.

In reality, stock prices often reflect investor psychology as much as they reflect fundamentals. Markets move not only because of data, but because of how people interpret and react to that data.

👉 The same information can lead to very different actions:

- 📈 One investor sees opportunity → buys more

- 📉 Another sees risk → sells

The difference often comes down to investment psychology and emotional response.

🧠 Why Emotions Often Override Logic in Investing

We tend to believe we make rational financial decisions. But neuroscience research shows emotions play a major role in how decisions are formed.

A well-known behavioral experiment illustrates this:

🍷 When participants believed a wine was more expensive, they rated it as tasting better — even when it was identical to cheaper wine.

This highlights an important truth:

- Financial decisions are rarely purely rational

- Investor psychology shapes how we interpret information

(Reference: Neuroscience News — Emotion & Decision Making)

⚖️ Prospect Theory: Why Losses Hurt More Than Gains Feel Good

One of the foundational theories in behavioral finance is Prospect Theory (1979). It suggests:

👉 People feel the pain of losses more strongly than the pleasure of equivalent gains.

A simple example:

- 💵 Finding $100 → short-term happiness

- 💸 Losing $100 → frustration that can linger for days

In investing, this often leads to:

- Emotional stress during market declines

- Panic selling to “stop the pain”

This is a classic expression of investment psychology influencing behavior.

(Reference: Investopedia — Prospect Theory)

❤️ Emotions Aren’t Always the Enemy

It’s important to understand that emotions aren’t inherently negative.

They serve a survival function:

- 🧗 Fear of heights keeps you safe

- 💰 Risk awareness can prevent reckless financial decisions

👉 The real issue isn’t having emotions.

👉 It’s failing to recognize when emotions are driving investment decisions.

🏃 Fight or Flight: A Natural Response to Market Losses

When portfolios decline, investors often experience stress similar to other high-pressure situations.

Psychology describes this as the fight-or-flight response:

- 🧠 Fight → analyze calmly and reassess

- 🏃 Flight → sell quickly to reduce stress

In investing, the “flight” reaction frequently shows up as:

📉 Selling during market downturns — even when long-term fundamentals may still be intact.

This is another example of investor psychology shaping market behavior.

(Reference: Harvard Medical School — Stress Response)

🚀 Why Investors Feel Confident Near Market Peaks

When markets rise:

- 📰 Positive news becomes more common

- 📱 Social media amplifies optimism

- 😊 Investors feel safer and more confident

This environment can create:

✔ Confirmation bias (seeking information that supports existing beliefs)

✔ Overconfidence

✔ Buying at elevated prices

This often contributes to the familiar cycle:

👉 Buying high and selling low.

🔄 The Investor Emotional Cycle

Market psychology often follows a predictable emotional cycle:

1️⃣ Optimism — initial hope

2️⃣ Excitement — profits build confidence

3️⃣ Overconfidence — risk perception drops

4️⃣ Anxiety — market uncertainty increases

5️⃣ Fear/Panic — losses intensify stress

6️⃣ Capitulation — investors sell to relieve pressure

Understanding this cycle can help investors recognize emotional influences before making decisions.

(Reference: Edward Jones — Emotional Cycle of Investing)

🧭 How to Manage Investment Psychology More Effectively

🎯 1. Define Clear Investment Goals

“Making money” isn’t a plan.

Clarify:

- Time horizon

- Risk tolerance

- Realistic expectations

Clear goals help anchor decisions during volatility.

📊 2. Develop a Structured Investment Plan

A disciplined strategy reduces emotional decision-making:

- Appropriate asset allocation

- Suitable financial instruments

- Consistent rebalancing discipline

A plan acts as a buffer against emotional reactions.

🔎 3. Recognize Emotional Signals Before Acting

Before making investment decisions, ask yourself:

- Am I reacting emotionally or analytically?

- Does this align with my long-term plan?

- Would I make the same decision if markets were calm?

Self-awareness is one of the most powerful investing tools.

✅ Final Thoughts: Understanding Yourself Is As Important As Understanding the Market

Financial markets are not driven by numbers alone — they are driven by human behavior.

When you understand:

✔ Your risk tolerance

✔ Your financial goals

✔ Your emotional responses to market movements

👉 You can avoid many common investing mistakes, including:

- Buying high and selling low

- Panic selling during downturns

- Overconfidence in bull markets

A clear plan and emotional discipline are key to sustainable investing success.

📚 Sources Referenced

- Neuroscience News – Emotion and Decision Making

https://neurosciencenews.com/emotion-reason-decision-making-25803/ - Investopedia – Prospect Theory

https://www.investopedia.com/terms/p/prospecttheory.asp - Harvard Medical School – Stress Response (Fight or Flight)

https://www.health.harvard.edu/staying-healthy/understanding-the-stress-response - Edward Jones – Emotional Cycle of Investing

https://www.edwardjones.com/sites/default/files/dam//ang-4417-a.pdf

Disclaimer: This content is for educational purposes only and does not constitute personalized investment advice. Every investor’s situation and objectives are different.